Summertime for me, means heading to my parents lake house and getting the smoker prepared for some BBQ. Ribs/Pulled Pork/Brisket — it’s hard to choose just one. And then there are all the side dish options. I wanted to share 2 of my go-to summer staples.

Spicy Peach BBQ Sauce

The sweetness of the peaches with the spiciness of the bbq sauce is perfectly delicious combo! It’s best when you use fresh, ripe peaches.

I will use this with my smoked pulled pork, but it is also great on any grilled meats; chicken, etc. It’s very good with chicken drums and thighs.

Ingredients:

1 cup tomato sauce

1/4 cup apple cider vinegar

1/4 cup packed brown sugar

1/4 cup honey

2 tablespoons Worcestershire sauce

1/2 teaspoon onion powder

1/2 teaspoon garlic powder

1/2 teaspoon kosher salt

1/8 teaspoon cayenne pepper

2 fresh peaches peeled and chopped

1/2 cup peach preserves

How to Prepare:

- Chop your peaches

- Combine tomato sauce, apple cider vinegar, brown sugar, honey, Worcestershire sauce, onion powder, garlic powder, salt, pepper, and chopped peaches in a medium saucepan

- Cook on medium heat. Bring to a low boil and then cook for about 10 minutes until thick. You’ll know it’s ready when it coats the back of a spoon.

- Add the peach preserves and stir.

Serving:

You can serve immediately or store in an airtight container in the refrigerator for up to 3 days.

HINT: *if putting it on meat as a marinade, be careful not to burn the sauce and keep the temp lower. The natural sugars in the peaches can easily burn if they get exposed to direct flame. To avoid this, I prefer to not sauce any of my BBQ until it is just about finished cooking.

Avocado Corn Salad

I make this multiple times every summer. I like it in part, because it doesn’t take very long to make and you can make ahead of time and store in a cooler. It’s shelf life in the refrigerator is at least a few days. For larger groups, it’s easy to just increase the ingredient quantities.

When you encounter its sparkling flavor and multitude of textures, I think you’ll agree it goes with almost everything you can think of when you think “summer spread”.

I’ve served it with:

- Grilled beef

- Grilled pork

- Various chicken entrees

- Chicken Kabobs

Other ways to serve it include:

- As a chunky dip/salsa

- Over/in tacos.

Ingredients:

Corn Salad

5 ears fresh corn husked with silks removed

1 1/2 tablespoons extra-virgin olive oil

2 teaspoons kosher salt

3/4 teaspoon black pepper

1 pint halved cherry tomatoes about 2 cups

2 cups packed arugula

1 medium avocado peeled, pitted, and diced

1 small red bell pepper cored and finely chopped

4 green onions finely chopped

1/4 cup chopped fresh cilantro

Dressing

1/4 cup fresh lime juice from about 2 limes

2 tablespoons extra-virgin olive oil

1 tablespoon honey

1 teaspoon paprika

3/4 teaspoon kosher salt

1/4 teaspoon black pepper

1/4 teaspoon onion powder

How to Prepare:

- Corn by itself may taste bland. Grilling corn makes it more flavorful. But if you don’t have a grill, you can also cook it in the oven or on a stovetop.

- Make sure your grill is preheated to about 400 degrees F (Medium on many grills)

- Lightly Rub the corn with olive oil, then sprinkle with salt and pepper.

- Once your grill is ready, place the cobs on for about 7 minutes, turning every few minutes. The cobs should turn light brown.

- Take them off the grill to a place where they can cool.

- Remove the kernels from the cob with a knife on a cutting board.

- Transfer them to a large mixing/serving bowl.

- Add the cherry tomatoes, arugula, avocado, bell pepper, green onions, and cilantro.

- In a small bowl, stir together the lime juice, olive oil, honey, paprika, salt, pepper, and onion powder.

- Pour over the salad tossing until well mixed.

- Serve at room temperature!

Storage

If you’re storing in a refrigerator for a few days:

You may notice the avocado browning slightly. The argula may also begin to wilt. NOT TO WORRY! — your creation will retain its delicious flavor. As an option, you can prepare the salad in advance without the avocado and simply add it in before serving.

Favorites from My Cookbook Shelf

I really like this cookbook — great meals that are quick to prepare. I also get a lot of inspiration from Matt Pittman's website. He also has a youtube channel with a ton of recipes. I have learned a lot watching his videos over the years

Many families choose summer as the season for their family reunions. Summer is also a busy time for most people. With coordinating schedules, dealing with family dynamics, transportation issues, and much more, planning your reunion, no matter how many people will attend, is crucially important.

Families hold reunions for different reasons, but one of the most common and important ones is building and maintaining strong family bonds and keeping communication flowing.

Given how far-flung most American families tend to be these days, family reunions can play a critical role in maintaining those connections.

While it’s true that this can be especially important for older family members who may otherwise feel their increased isolation, reunions are important for people of all ages. Consider the stories elders may tell about their childhood with grandchildren, grandnieces or grandnephews. While kids realize that the aging elder before them was once a child too, actually imagining the older person as a child, can strengthen cross-generational bonds.

When planning, it’s important to remember that some of your family members may have different expectations than you. So it’s best to build a consensus and then confirm the plan other key family members, who will then communicate what’s planned with the rest of the family.

Factors

Perhaps someone’s home can comfortably accommodate a reunion. Factors may include:

- Home, room and lawn size

- Number of bathrooms

- An out-of-the-way place for elders to rest, or small children can nap

- Enough tables and chairs for everyone

- Parking

- Receptivity of neighbors for a large gathering.

Locations (other than a home) to Consider

Choosing an exciting location can not only spice up the event, but can be a way to entice family members to attend. Some possibilities include:

- Summer home

- Hotel, resort, or rented cabin

- Campground

- Park

- Community Center

- Favorite restaurant

- Club Facilitites

Activities

Remember that some activities appropriate for certain members, may not be for others. Make sure you offer a range so that everyone can participate in something.

- Outdoor excursions (on land or water)

- Shared meals

- Games Traditional two-legged races, egg tosses and musical chairs are as fun as ever! But there are plenty of ideas online, as well.

- Activities that involve passing down family history and stories. Consider a trivia game where multigenerational teams work together. Talk about a great bonding moment!

- Make it a potluck and ask everyone to bring something that somehow relates to family history.

- Create a display that may include mementos and photos. These can be analog, or, if your location has electricity, digital.

- Take lots of photos, both candid and the obligatory group shot. You can use them in your display at your next reunion.

- Day trip: Make it an adventure by trying something new!

- Arts and Crafts, including:

- Making name tags. Name tags can be helpful for older folks who may not necessarily be able to distinguish little Johnny from little Ben.

- Have everyone bring a photo of themselves and create a poster with their photo and a mention of something they did over the last year.

- Plan head. Give yourself at least. That’s right, especially for larger family events. Coming up with a date everyone (or at least most) can attend can itself be a daunting task. Add to that communication lag, transportation issues and you can see why planning a year ahead is important.

- Date and location. The location of your reunion can affect the ability for some to attend, or not. Send out a poll to family member asking for available dates and desired locations.

- The budget. Consider the cost and cost sharing for each member to attend. Remember; some members may be more financially able to afford flights, lodging, venue fees than others. Starting a family fund and encouraging people to chip in can be good way to help defray the burden for some family members. Whether you choose to divide funds evenly or base it entirely on need is up to your family. Reporting the fund’s progress on a monthly basis can be great way to keep your reunion “top of mind” for your family members.

- Invitations. Once your plans are firmed up, send out notices ASAP. Then follow up with a reminder at least six weeks in advance.

- You’re not in this alone! Delegate responsibilities to other family members. Request volunteers to help with planning. The last thing you want is to become overwhelmed. Besides, it’s likely others will want to help. Planning may include budget, reservations, food coordination, travel & lodging, entertainment, and a person to be the main point of communication.

- Create an event schedule. This can be printed out and handed to attendees as they arrive or posted to a white board or poster somewhere visible to all.

- Welcoming attendees: If your reunion is sizeable, consider a booth or table where a few family members can greet and orient people as they arrive. This might include food and drinks, a few games, and a welcome speech from a senior member of the family.

- The hope before, during and after your reunions is likely that the majority of the family members found the gathering to be both satisfying and generally worthwhile. Family reunions are meant to be fun – but they are also an important time to set aside the stress of life and focus on family.

It’s occurred to us that both the planning for, and results of a family reunions are not dissimilar in ways to the family meetings we offer, and in fact encourage for our clients. Planning for the future and maintaining good communication about life values, goals and intensions is important in most families. We gather client’s family members together to discuss many different topics important to them. In doing so, we act as a resource for the entire family even if some are not current clients. Family meetings can be beneficial to members of any age. It’s important for those just starting out in life. It’s important for mid-career working parents who want to balance an investment in their children’s future college costs, as well as their own eventual retirement. And it’s important to those who are beginning to plan for their transition to Senior Care and their legacy.

To learn more, watch this video!

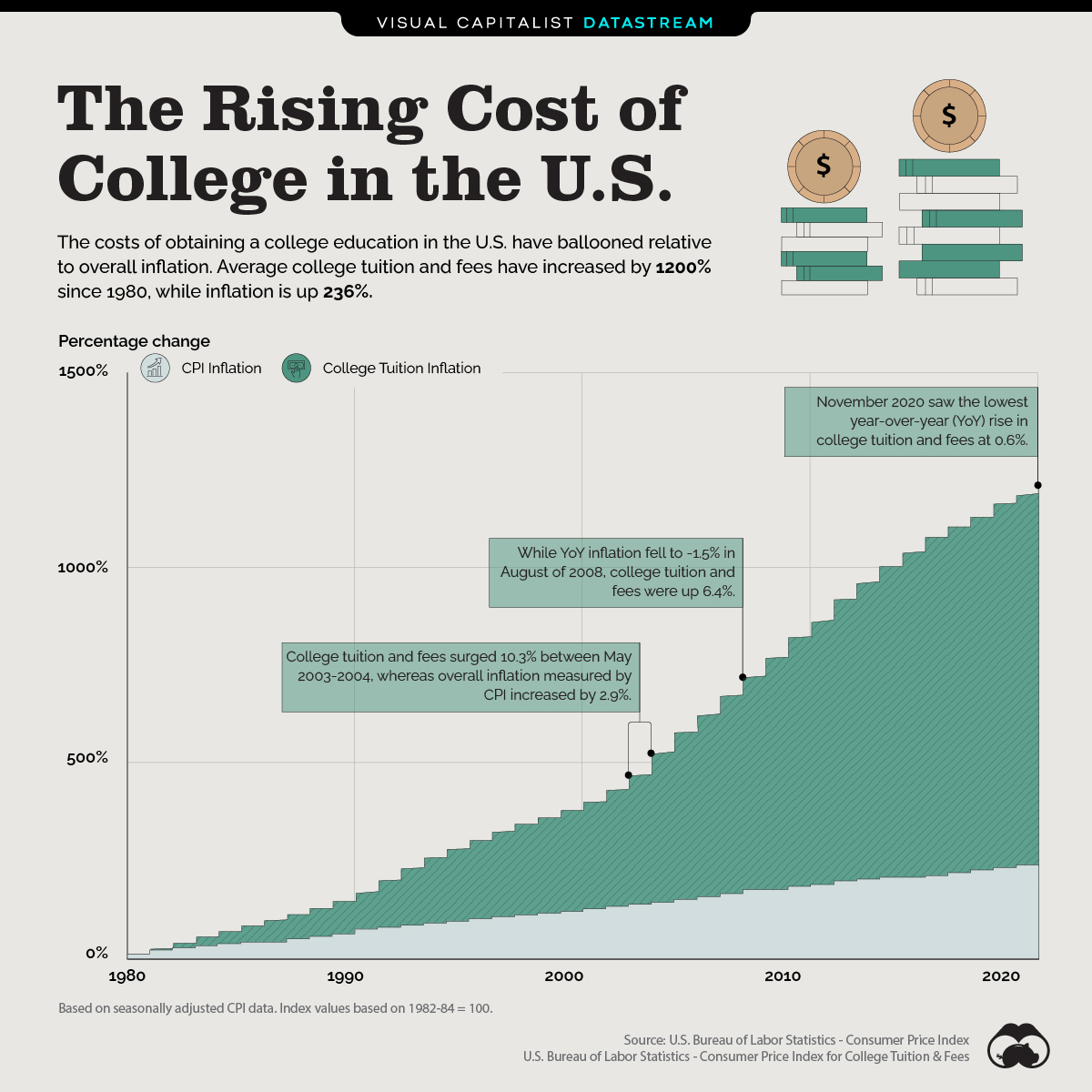

The Rising Cost of College Education and What You Can Do About It.

Many of us look back on our college years as having been an opportunity to not only strengthen our knowledge in preparation for a career, but to prepare us for our adult life by offering a relatively safe and secure period for us to stretch our wings while our parents continued to support us — a chance to grow into ourselves without all the responsibilities and financial burdens of adulthood.

The good news is 529 Savings Plans can be both a powerful and flexible tax-free way for families to fund education. You may have heard about the 529, but you may not be aware of some of the more beneficial options and features.

For Instance:

Crowd-fund it. Well, not exactly, but just about anyone in your family can contribute – parents, grandparents, aunts, uncles.

Supercharge it. Federal law allows any qualifying family member to gift any 529 beneficiary up to $15,000 per year and not get hit with a gift tax. That means if the beneficiary has two parents, each can contribute $15,000 per year for a total of $30,000. Plus, in the first year of the plan, anyone can contribute up to 5 years worth of contributions (called the “5-year election”) up to a maximum total contribution of $150,000 and still avoid it being taxed as a gift as long as the person doesn’t contributes again for the subsequent 4 years. And like most other savings/investment plans, more money up front, usually means significantly more money for the student later.1

Use it to fund K-12 Private schools. A new feature since 2019, you can now use a 529 to pay up to $10,000 per year for tuition for kindergarten through high school. This gives young couples even more incentive to enroll in a 529 plan even earlier than they might otherwise.1

Use it to fund K-12 Private schools. Once one beneficiary has completed their education, the plan can switch to another beneficiary. Effectively, the plan can be passed from one student to another, for generations! For the more affluent among us, a 529 can become a consideration when planning their legacy.

You can be both the contributor and the beneficiary. Usually, folks think of a 529 plan as a way to fund the education of their children and grandchildren, but yes! — you can also use it to fund your own academic pursuits!

Tax Deferred Growth and Deductions. Your money can grow tax-deferred, and as long as the proceeds are used to pay for qualified educationexpenses, any withdrawals are tax-free. There are also potential state and local tax deductions. However, it’s important to note that your taxable income is not reduced by contributing to a 529 plan. However, more than 30 states give out tax deductions or credits for contributions.

No income Limits. Unlike a Roth IRA, there are no limits to income for those who can contribute to a 529 plan.

High Limits on Contributions There are indeed limits to how much money can accumulate in a plan. Those limits are determined by the states, but they are all quite high. Georgia and Mississippi have the lowest limits at $235,000, based on the current expected cost to attend the most expensive college in the United States. In NH, the limit is $553,098 per beneficiary. 2

High Limits on ContributionsThere are indeed limits to how much money can accumulate in a plan. Those limits are determined by the states, but they are all quite high. Georgia and Mississippi have the lowest limits at $235,000, based on the current expected cost to attend the most expensive college in the United States. In NH, the limit is $553,098 per beneficiary. 2

Select the State plan that works best for you — Every state offers a plan, and their features, rules and benefits vary. You are not limited to select a plan in the state where you or the beneficiary resides. You can choose a plan in any state and can even have multiple 529 plans in more than one state at a time.

In addition to all these options and benefits, there are two types of 529 plans to consider: prepaid tuition plans and savings plans.

Graphic attribute: Visual Capitalist

We’re here to help you explore 529 options and plan types so you can determine what will work best for you. In addition, if you’d like to discuss scheduling a family meeting, click this link to make an appointment with us today!

Liana Poodiack, CFP®

Managing Director, Financial Advisor

34 West Street • Keene, NH 03431

(603) 827-4068

One of my clients contacted me expressing concerns with their parent’s overall estate plan and how it might impactthem and their siblings. In the past, there had been conversations with parents and children separately, but never all together. As a result, communication had broken down, which led to disorganization and inaction among the family

My client came to us with a request that we help guide the family through a family meeting to figure out and work through some of the concerns and potential issues.

We met and uncovered the following issues:

Situation:

A rental property they owned was not generating enough rental income and the parents were going to need more access to money for additional care. They were considering the sale of the property without a full understanding of the tax consequences of the transaction and how the family should go about setting up the deal.

Issues:

The property was currently in a Family LLC for a residential property. Upon sale, the way the LLC was owned would have created a large tax burden for the Heirs/Children.

The ownership of the property was also creating issues with the children who were owners in the LLC. This was impacting things like eligibility for College Benefits since the property was considered an asset of all the Owners in the LLC.

When the document was created “the LLC agreement” it did not provide for guidance and flexibility in transferring ownership among remaining members. Future, property costs and upkeep were a concern for some of the children.

Solution:

We discussed the pros and cons of selling versus keeping the property in regards to the capital gains tax consequences. We discussed cost basis and what was needed to establish the basis for tax purposes; initial cost and improvements that would potentially increase the cost basis. We also considered the valuation at first death, all with the aim to help lessen the amount of capital gain exposure.

We provided guidance for them in regards to selling the property, getting a realtor to provide an estimated current value, and also to help assess what the value would have been at the time the first spouse passed away to provide a 50% stepped up basis. We walked the family through the steps necessary to establish a cost basis in the property, and modeled different outcomes for selling the property now, or at death to see the different tax consequences for the family so they could make a decision.

LLC Solution:

Raymond James reviewed LLC document and pointed out the following issues:

No stepped up cost basis at the Matriarch’s death

No guidance about ongoing costs to upkeep, and the burden on membersWe recommended hiring an attorney who specializes in estates and family LLC for a possible rewriting of the LLC. We convened another family meeting with their attorney. During the meeting we facilitated all of the families concerns with the current ownership of the LLC and the potential conflicts that could arise down the road.

Their attorney reviewed all the documents and made recommendations on how to solve the issues with an LLC ownership change and with LLC amendments including new estate documents that provided for tax benefits of LLC ownership for the next generation.

The family felt that the family meetings we had helped them think through the overall situations and stay focused on accomplishing their goals.

RESULT:

By us leading the family through multiple family meetings and looping in other outside professionals, we were able to help get the family organized and on track with getting the various issues resolved and addressed.

Disclaimer

Securities and investment advisory services offered through Steward Partners Investment Solutions, LLC, registered broker/dealer, member FINRA/SIPC, and SEC registered investment adviser. Investment Advisory Services may also be offered through Steward Partners Investment Advisory, LLC, an SEC registered investment adviser. Steward Partners Investment Solutions, LLC, Steward Partners Investment Advisory, LLC, and Steward Partners Global Advisory, LLC are affiliates and separately operated.

Case Study Disclaimer

The case study presented is provided for illustrative purposes only. Past performance is no guarantee of future results. The information has been obtained from sources we believe to be reliable, but we cannot guarantee its accuracy or completeness. These strategies do not guarantee a profit or protect against loss and may not be suitable for all investors. Each customer’s specific situation, goals, and results may differ. Neither the information provided, nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

Investors should consider many factors before deciding which 529 plan is appropriate. Some of these factors include: the Plan’s investment options and the historical investment performance of these options, the Plan’s flexibility and features, the reputation and expertise of the Plan’s investment manager, Plan contribution limits and the federal and state tax benefits associated with an investment in the Plan. Some states, for example, offer favorable tax treatment and other benefits to their residents only if they invest in the state’s own Qualified Tuition Program. Investors should determine their home state’s tax treatment of 529 plans when considering whether to choose an in-state or out-of-state plan. Investors should consult with their tax or legal advisor before investing in any 529 Plan or contact their state tax division for more information. Morgan Stanley Smith Barney LLC does not provide tax and/or legal advice. Investors should review a Program Disclosure Statement, which contains more information on investment options, risk factors, fees and expenses and possible tax consequences.

Steward Partners Investment Solutions, LLC (“Steward Partners”), its affiliates and Steward Partners Wealth Managers do not provide tax or legal advice. You should consult with your tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters.

PWM newsletter 07/07/2023 ADtrax – 4803186.1

Footnoters

1] Source: https://www.pnfp.com/learning-center/personal-finance/investing/what-affluent-families-need-to-know-about-529-plans-for-college-savings/

2] Source: Source: https://www.investopedia.com/articles/personal-finance/010616/529-plan-contribution-limits-2016.asp